There are so many moving parts to buying a home. From negotiating the sales contract to scheduling inspections to making sure you’re able to obtain mortgage commitment on time. While this all may seem insurmountable at first, a little bit of planning and preparation can go a long way!

1. Learn what your credit score REALLY is

News flash! Credit Karma isn’t very accurate when it comes to detailing what your score is. Mortgage companies pull 3 credit scores (one from each credit bureau) and I have yet to see them line up with the estimation from Credit Karma. Part of this is due to the fact that different types of industries will weigh trade lines differently. What a mortgage company values probably isn’t the exact same as a car dealership or credit card company.

Curious where to get a more accurate assessment of your credit scores?

Visit: Annual Credit Report

This website allows you to pull your full credit report, showing scores from all 3 credit bureaus. You can do so once per year, free of charge. This website is also backed by the CFPB (Consumer Financial Protection Bureau).

Verify here: CFPB – How to get a copy of your credit report

It’s also not all about the score itself. There are some particulars to look for in the actual trade line history. Recent late payments can be an issue, even if they don’t drop your score immensely. Past bankruptcies, foreclosures and collections can also be problematic – even if you have built your actual score back up. Prior delinquencies are all handled differently based on the type of loan you wish to qualify for and the lenders your loan officer is looking to potentially use.

2. Start checking those bank statements

The majority of loan products are going to require 2 month’s most recent bank statements. Now, it’s not enough to just provide those statements to your loan officer! The underwriter will be reviewing to look for a few keys items…

a) Overdraft or NSF charges – Having these fees can indicate to an underwriter that you aren’t always able to pay your bills. If you have a history of collecting these fees, start regularly checking your account balance. Create reminders specific to your major bills so you remember to check your balance BEFORE those funds are drawn from your account. While we can usually work with an underwriter to explain a couple charges, it’s not a guarantee so it’s best to start monitoring your account early on.

b) Cash deposits – I’ve mentioned this in previous blogs but cash deposits (depending on their size) can be a big red flag to underwriters. Even if those funds are legitimate, it’s almost impossible to document and verify where they came from. Cash just can’t be tracked the same way checks, ACH deposits and online transfers can be. If you’ve started to consider purchasing a home, take a look at where your deposits are coming from.

c) Pay stubs – This point goes somewhat hand in hand with the cash deposits item. In the past I have seen clients cash their pay stubs in full for budgeting purposes. They would take a certain portion for spending during the week and then deposit the remainder at the end of the week. This is so hard to verify!! If you prefer spending cash, that’s totally fine! Just start having your pay stub deposited in full, then withdraw the cash you would like from an ATM. This will help SO much with the underwriting process.

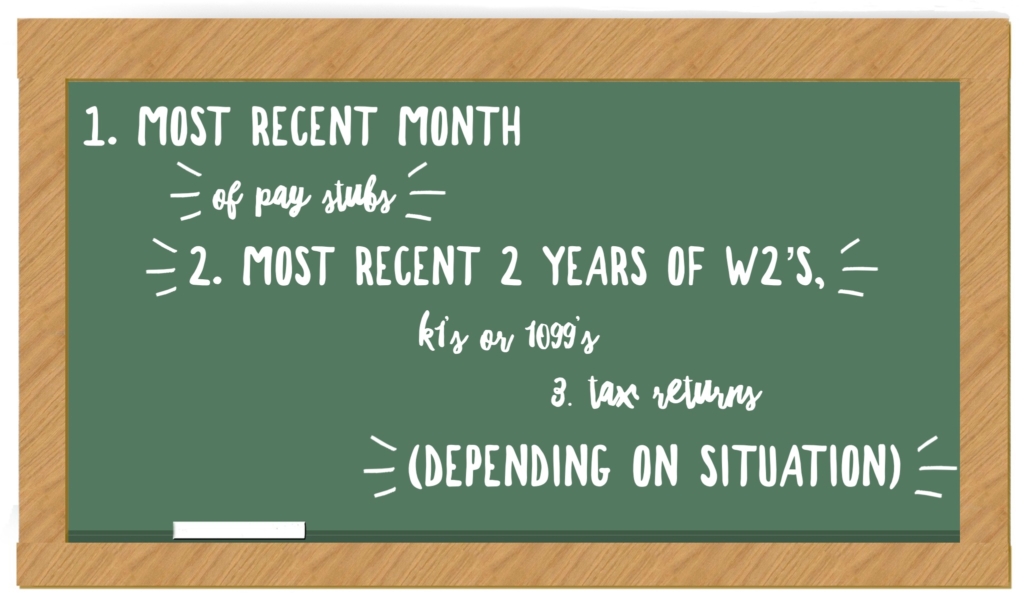

3. Find those pesky documents

It’s no secret, getting a mortgage requires a few pieces of paper (lol). The exact documentation required will depend on the loan you’re qualifying for, but your loan officer should be able to give you a good idea of what underwriting will need from you. Here are a few of the items that tend to be the most difficult to track down:

4. Start thinking about where your down payment is coming from

Some loan programs do offer 100% financing but take the time to learn what costs are associated with your specific loan. Most programs have minimum down payment requirements. I see a lot of confusion over ads that claim “no cost loans”. To be honest, I’m in the industry and I don’t even know what that really means! That phrase implies there is no down payment but that probably won’t be the case! Your loan officer can usually roll closing costs, prepaids and escrows into your loan amount. But if you aren’t willing to increase your loan amount, or the sellers won’t agree to a seller credit to make that happen, keep in mind you are going to incur additional costs at the closing table, in addition to the down payment.

Not only is it a good idea to dig into what the real costs of a mortgage would be, but it’s also helpful to think about where those funds are coming from. The guidelines differ on where closing funds can come from and what documentation is needed depending on the type of mortgage you’re looking at. Gifts are usually acceptable, but you can’t get them from any ol’ friend if you want to get an FHA loan. Plus the donor needs to back up where those funds are coming from (no mattress money!). Retirement funds are acceptable but underwriting doesn’t allow you to use 100% of the available funds – plus withdrawal terms differ. Talk to a loan officer about your specifics if you want to start preparing ahead of time!

5. Get prequalified

I know, shocking. The mortgage company is recommending you get prequalified before starting your house search! But seriously, making sure you can buy a house before you start looking at them is huge! You don’t want to fall in love with a home just to find out you aren’t in a position yet to buy one. Or conversely, what if you qualify for MORE than you originally anticipated? (I have seen both sides of the spectrum). And if you find out you can’t prequalify right now, don’t freak out! Your loan officer can work with you to get you to a place where you are able to purchase a home. We are here to help!